Urban redevelopment continues to accelerate across Australia, supported by rising infrastructure investment and strong migration-driven demand. According to the Australian Bureau of Statistics (ABS), Australia’s population grew by 2.4% in 2023–24, the fastest rate in more than a decade, with NSW absorbing a large share of new arrivals. This expansion has intensified pressure on housing supply, especially in Sydney’s western growth corridors.

Against this backdrop, a Shanghai-backed developer has formally filed a $1.1 billion Penrith masterplan, proposing a large-scale mixed-use project intended to support long-term economic and housing needs in Western Sydney. This article analyses the project through an investor and policy lens, exploring market conditions, strategic frameworks, infrastructure relevance, and stakeholder implications.

We will examine the redevelopment using evidence-based insights from global benchmarks, proven planning models, and Australia’s current real estate indicators to offer a balanced, professional assessment.

Market Overview — Why Penrith Is a Strategic Investment Zone

Quick Summary

Penrith has emerged as a high-priority urban zone due to population growth, infrastructure spending, and Western Sydney Airport-related investment momentum.

Population & Demand Pressures

- ABS data shows Western Sydney accounts for over 45% of Greater Sydney’s population.

- Home prices in outer-metro areas increased as affordability drives buyers away from the CBD (CoreLogic 2024).

- Rental vacancy rates in Western Sydney sit below 1.3%, indicating strong demand.

Infrastructure Catalysts

The Penrith masterplan aligns with several regional economic anchors:

- Western Sydney International Airport (opening 2026)

- $20bn NSW transport upgrades (NSW Gov, 2024)

- Science Park and health innovation precincts

These factors increase both investor confidence and commercial viability for large projects.

Project Breakdown — Components of the $1.1bn Masterplan

Mixed-Use Development Strategy

The Shanghai developer’s proposal reportedly includes:

- High-density residential towers

- Retail and commercial floorspace

- Public recreation and green spaces

- Improved pedestrian access

- Integrated transport-friendly planning

This model mirrors global urban redevelopment strategies seen in Shanghai, Singapore, London, and Vancouver, where mixed-use design supports sustainable density.

Why Mixed-Use Matters

Mixed-use districts reduce resident commute times, diversify revenue for developers, and improve the long-term economic resilience of the area.

Challenges & Pain Points

Regulatory Complexity

Large-scale projects in NSW often face:

- Planning approval layers

- Environmental and ecological assessments

- Community consultations

- Local infrastructure contributions

Delays can extend years, affecting timelines and capital deployment strategies.

Construction Costs

Deloitte’s 2024 Construction Outlook notes that Australia continues to experience:

- High labour demand

- Material price volatility

- Skilled worker shortages

These pressures can impact budgets and delivery phases, especially on billion-dollar projects.

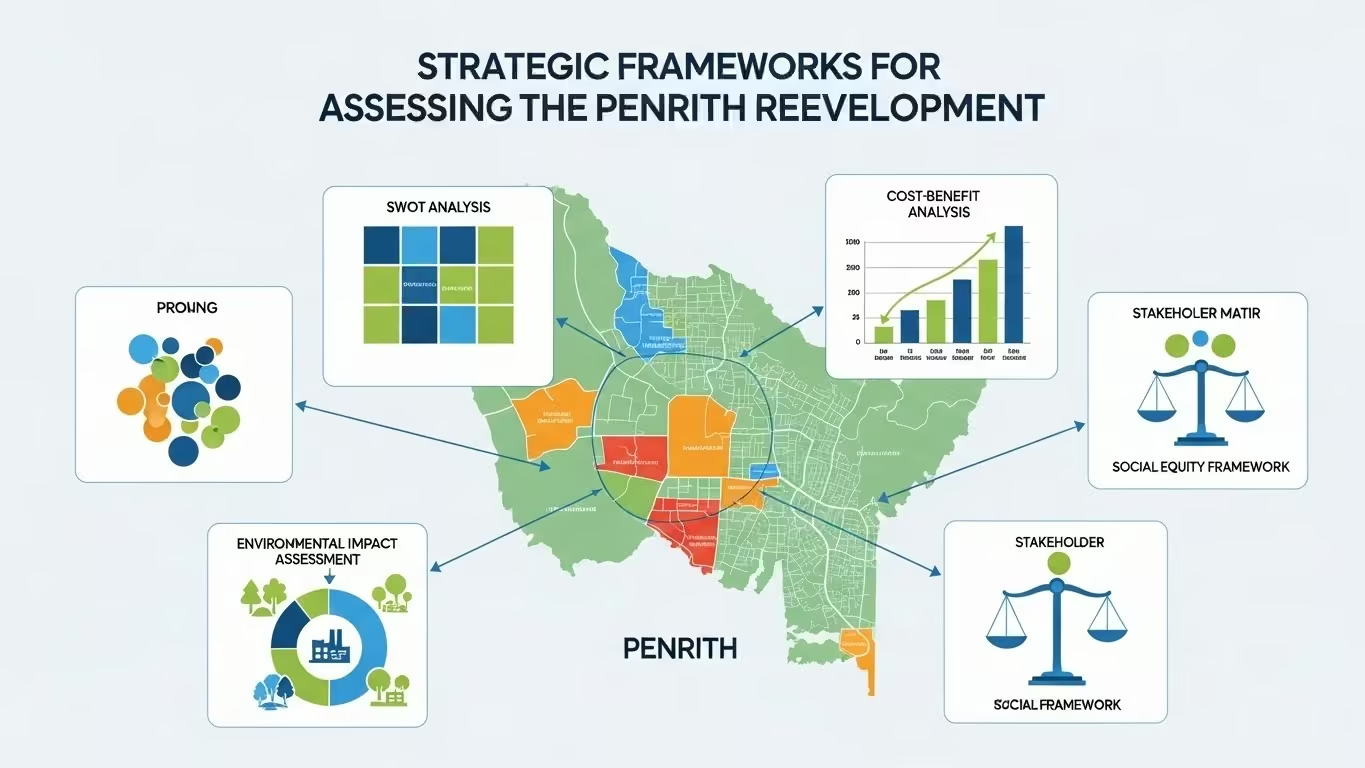

Strategic Frameworks for Assessing the Penrith Redevelopment

SWOT Analysis

| Factor | Detail |

|---|---|

| Strengths | Strategic location, alignment with Western Sydney Airport growth, and rising housing demand |

| Weaknesses | Long approval processes, high development costs, and potential market fluctuations |

| Opportunities | Ability to set new urban design benchmarks, attract foreign investors, and create jobs |

| Threats | Economic cycles, interest rate sensitivity, and regulatory changes |

The AIDA Model for Urban Engagement

This redevelopment can be evaluated using AIDA (Attention, Interest, Desire, Action):

- Attention: Billion-dollar scale captures regional focus.

- Interest: Government infrastructure alignment boosts credibility.

- Desire: Local demand for housing and modern amenities is strong.

- Action: Investors and stakeholders await council decisions on planning approval.

Case Studies — Global Comparisons for Context

Shanghai Urban Clusters

Shanghai’s own major redevelopments, such as Xujiahui Centre and Lujiazui expansions, emphasize:

- High-density vertical living

- Transit-oriented development

- Public-private collaboration

These strategies often produce high economic returns and sustainable community outcomes.

Parramatta Square (Sydney)

This NSW example demonstrates how long-term planning can transform an area into a commercial hub through:

- Mixed-use towers

- Public precincts

- Civic investment

The Penrith redevelopment follows a similar trajectory.

Implementation Strategy — What Comes Next?

1. Planning Determination

The local council and NSW planning authorities will review:

- Environmental impact statements

- Community feedback

- Infrastructure compatibility

- Housing affordability contributions

2. Staged Construction

Mega-projects often roll out in:

- Early works

- Residential construction

- Commercial precinct delivery

- Public-space enhancements

3. Stakeholder Engagement

Developers typically collaborate with:

- Local businesses

- Council committees

- Transport agencies

- Investor groups

ROI & Impact Measurement

Even though the exact ROI cannot be speculated, standard industry metrics for assessing large-scale developments include:

Key ROI Indicators

- Net rental yield

- Pre-sale absorption rates

- Construction cost efficiency

- Commercial tenancy occupancy

- Long-term capital appreciation trends

Liveability & Social Impact Metrics

According to OECD urban benchmarks:

- Walkability scores

- Access to transport

- Community facility availability

- Environmental outcomes

are increasingly considered in evaluating long-term project success.

Conclusion

The Shanghai Developer’s $1.1bn Penrith Masterplan arrives at a critical time for Western Sydney. Strong migration, transport infrastructure upgrades, and rising housing demand create favourable conditions for a large-scale mixed-use redevelopment. While regulatory and construction challenges remain, the project could reshape Penrith’s urban core and strengthen its role in Sydney’s westward economic shift.

Urban planners, investors, and policymakers will continue monitoring approval progress and development stages over the coming years, recognising the project’s potential to redefine Western Sydney’s liveability and economic capacity.

FAQs

1. How is ROI measured for the Penrith masterplan?

Through tenancy uptake, residential absorption rates, development profits, and long-term value uplift — using established industry metrics.

2. What are the main risks?

Construction costs, regulatory delays, and economic cycles.

3. Does the Western Sydney Airport increase project viability?

Yes — historically, major airports improve commercial and residential demand within surrounding districts (OECD Urban Studies).

4. How does this compare to other major NSW developments?

It aligns closely with Parramatta Square and other mixed-use precincts focused on density and economic activation.

5. Who benefits most?

Residents, local businesses, investors, and long-term regional employment markets.